Door County Property Tax Rates

List Of Door County Property Tax Rates References. Find door county residential property tax assessment records, tax assessment history, land &, improvement values, district. Door county does have the ability to take online payments for taxes, keeping in mind that there will be an additional fee to do so.

Point &, pay credit card tax payment. Learn if real estate investing in door county wi is worth pursuing. Analyze our statistical data showing the local real estate investment market trends.

This Is The Total Of State And County Sales Tax Rates.

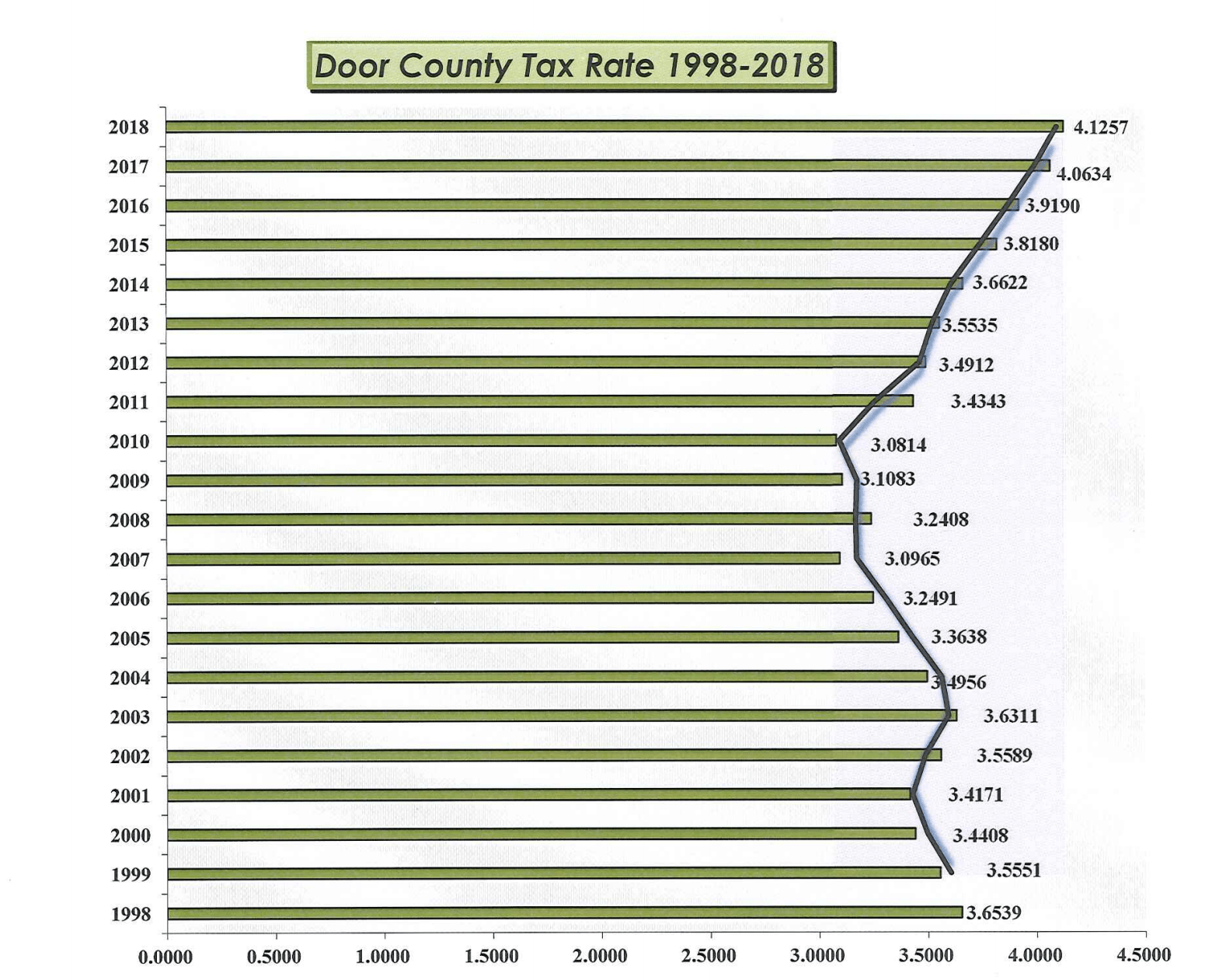

View tax maps for each town and village in wayne county. If you have a question about personal property taxes, please. Door county tax rates 2017 from connie erickson real estate in door county wisconsin.

The Median Property Tax In Door County, Wisconsin Is $2,357 Per Year For A Home Worth The Median Value Of $189,500.

Compare door county to other. Find door county residential property tax assessment records, tax assessment history, land &, improvement values, district. Nasewaupee is a town in door county, wisconsin, united states.the population was 1,873 at the 2000 census.the unincorporated community of idlewild is located.

The Wisconsin State Sales Tax Rate Is Currently %.

Wisconsin municipalities have various revenue sources to fund services, but they rely heavily on the property tax, deriving some 42.2% of their revenues from it. (920) 746 2287 (phone) (920) 746 2441 (fax) the door county tax assessor',s office is. [1] be equal and uniform, [2] be based on present market worth,.

Wisconsin Has A 5% Sales Tax And Door County Collects An Additional 0.5%, So The Minimum Sales Tax Rate In Door County Is 5.5% (Not Including Any City Or Special District Taxes).

The median property tax (also known as real estate tax) in door county is $2,357.00 per year, based on a median home value of $189,500.00 and a median effective property tax rate of. Free door county assessor office property records search. In the townproperty tax rate anywhere in the state.

Door County Does Have The Ability To Take Online Payments For Taxes, Keeping In Mind That There Will Be An Additional Fee To Do So.

Point &, pay credit card tax payment. Sturgeon bay , wisconsin , 54235. The 2020 property tax rates, calculated by the cook county clerk for more than 1,400 taxing agencies, were released today.

Post a Comment for "Door County Property Tax Rates"